Updated 12th December 2025 | Fact Checked By Jess Knauf, Co-Founder, Family Law Service

Financial Settlement on Divorce

Quick Summary: What You Need to Know About Financial Settlements

- Financial settlement on divorce means dividing all your assets, debts, pensions, and income fairly when you separate

- Courts look at needs first, then contributions, followed by equal sharing where possible

- You don’t automatically split everything 50/50, it depends on your circumstances

- Inheritance and gifts can be protected if you can prove they’re separate from marital assets

- A consent order makes your agreement legally binding and stops future claims

- Mediation or solicitor negotiation is usually faster and cheaper than going to court

What Is a Financial Settlement on Divorce?

Financial settlement on divorce is the legal process of dividing everything you and your ex-partner own, or owe, when your marriage ends. This includes your home, savings, pensions, businesses, debts, and even future income through spousal maintenance.

Many people assume divorce means splitting everything down the middle. The reality? It’s far more nuanced.

The court wants to reach a fair outcome, not necessarily an equal one. Fair means looking at what each person needs, what they contributed, and what’s reasonable given your specific situation.

We have collectively seen couples who’ve been together 30 years treated very differently from those married for three. We’ve work with clients who’ve built businesses during the marriage, inherited family homes, or sacrificed careers to raise children. Each case is unique.

The key is understanding what factors matter, what you’re entitled to claim, and how to protect yourself legally. Because without a proper financial settlement, your ex could come back years later asking for more.

Let’s break down exactly how this works.

How Does a Financial Settlement Actually Work?

When you divorce, any assets you own (whether jointly or separately) become part of the “matrimonial pot.” This is everything that’s up for division.

The court follows a clear hierarchy:

1. Needs come first

Can both of you afford somewhere to live? Can you cover basic costs? If there are children, their housing and welfare is the priority.

2. Compensation for contributions

Did one person give up work to care for children? Did someone bring significant assets into the marriage? These factors get weighed.

3. Sharing what’s left

If there’s money beyond meeting basic needs, the court leans towards equal division. But this isn’t guaranteed.

What Gets Included in the Pot?

Everything. Seriously.

- The family home (even if it’s in one name)

- Savings accounts, ISAs, premium bonds

- Pensions (often the biggest asset after property)

- Businesses and shares

- Vehicles, jewellery, valuable collections

- Inheritance (sometimes, more on this below)

- Debts (yes, these get divided too)

“We offer different levels of support depending on what clients need,” says Jess Knauf, Co Founder. “Our legal advice packages are perfect for people who feel confused or overwhelmed. We’ve had clients with settlement proposals from their ex-partner, and they simply don’t know if it’s fair. Our solicitors can review the offer, explain what you’re entitled to. Sometimes that one conversation changes everything.”

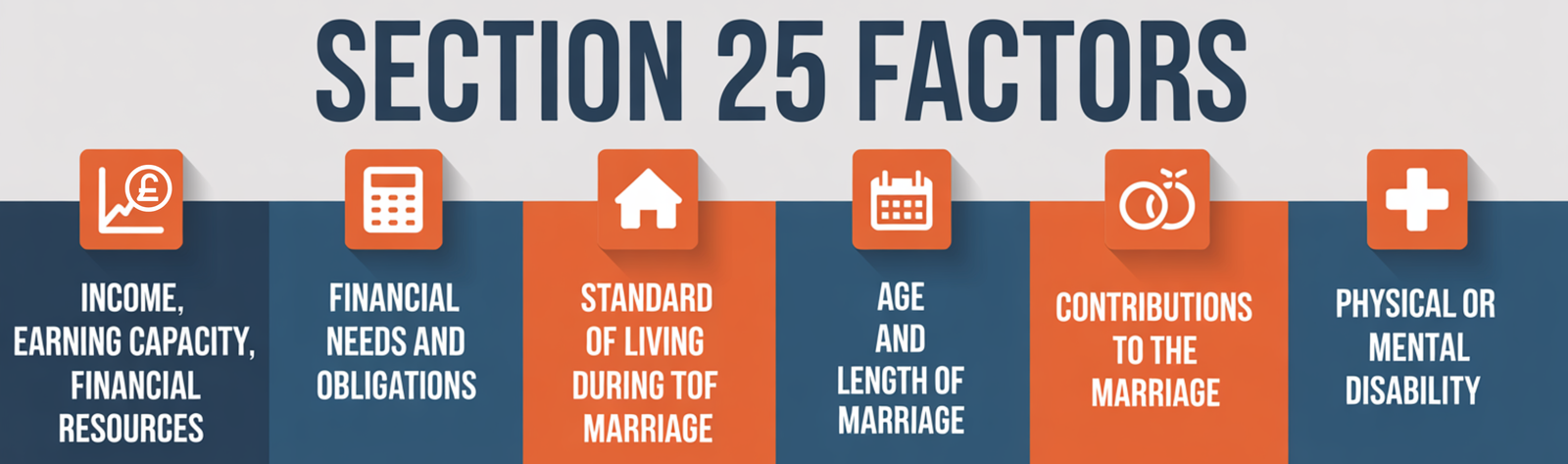

The Section 25 Factors: What Courts Actually Look At

When deciding how to split finances, courts use Section 25 of the Matrimonial Causes Act 1973. These are the factors judges must consider:

Income, Earning Capacity, and Financial Resources

What do you both earn now? What could you earn? If someone deliberately earns less to avoid paying maintenance, the court sees through it.

Financial Needs and Obligations

Rent, mortgage, childcare, council tax, utilities. Courts want both parties to maintain a reasonable standard of living.

Standard of Living During the Marriage

If you had a comfortable lifestyle, courts try to maintain that for both of you. But if there’s simply not enough money, needs trump lifestyle.

Age and Length of Marriage

Short marriages (under five years) often mean less sharing of assets brought into the marriage. Longer marriages see more pooling of everything.

A couple married 25 years will likely see a 50/50 split of assets. A couple married 18 months? The person who brought in a £500,000 inheritance probably keeps most of it.

Contributions to the Marriage

Financial contributions matter, but so do non-financial ones. Raising children, managing the home, supporting your partner’s career, these all count.

The landmark case White v White [2000] established that homemaking contributions are equal to financial contributions. A stay-at-home parent who enabled their spouse to build a career deserves equal recognition.

Physical or Mental Disability

If one person has health needs that affect earning capacity or require additional support, this influences the settlement.

Conduct (Rarely Relevant)

You’d have to do something truly extreme for conduct to matter. Affairs, spending money, being difficult? Courts don’t care. But hiding assets, deliberately running up debts, or domestic abuse? That can affect the outcome.

The Family Home: Who Gets It?

For most couples, the house is the biggest asset.

Courts consider:

- Children’s housing needs – If kids live primarily with one parent, that parent often gets to stay in the home (at least until the children are older)

- Can you afford two properties? – If not, the house may need to be sold

- Who can buy someone out? – If one person can remortgage to release equity, that’s an option

- Clean break vs deferred sale – Sometimes the sale is delayed until children turn 18

Real Example

Mediate UK worked with a couple where the husband wanted to keep the family home. He had a high income and could remortgage to buy out his ex-wife’s share.

His ex agreed, provided she received 60% of the equity (not 50%) to compensate for her lower earning potential. They negotiated this as part of a clean break settlement, and both walked away satisfied.

Want to get started? Just enter your name and we’ll guide you through the next steps.

Get Started HerePensions: The Hidden Asset in Divorce

Pensions are often worth more than the house.

Yet many people forget about them entirely. Big mistake.

There are three ways to deal with pensions in a financial settlement:

1. Pension Sharing Order

This splits the pension at the point of divorce. Your ex gets a percentage transferred into their own pension pot.

It’s clean, fair, and means no ongoing connection.

2. Pension Offsetting

One person keeps their full pension, but the other gets a bigger share of another asset (like the house).

This can work if you want to avoid splitting pensions, but be careful. A £300,000 pension isn’t the same as £300,000 in property because of tax and access rules.

3. Pension Attachment (Rare)

Your ex receives a portion of your pension income when you retire. This keeps you financially connected, which most people want to avoid.

Inheritance and Gifts: Can You Keep Them?

This is one of the most common questions we get.

Short answer: It depends.

When Inheritance Stays Separate

- You inherited money before the marriage

- You kept it in a separate account and didn’t use it for joint expenses

- The marriage was short

- Both of you can meet your needs without it

- You inherited during a long marriage and it’s been mixed with marital assets

- You used it to buy the family home

- One of you has pressing financial needs (like housing) and the inherited money is the only way to meet them

The case K v L [2011] made clear that even large inheritances can be claimed if needed to meet housing needs, especially after a long marriage.

One of our clients inherited £250,000 from his father. He’d been married 22 years. He used some of the inheritance to renovate the family home. When he divorced, his ex successfully argued she was entitled to a share because:

- The marriage was long

- The money had been used for joint benefit

- She had no other way to afford housing

He kept 65% of the inheritance, she received 35%. Not ideal for him, but legally fair

Business Assets and Self-Employment

If you or your spouse own a business, things get complex fast.

Courts will value the business and decide if it should be:

- Sold and the proceeds split

- Kept by the business owner, with the other spouse compensated through other assets

- Transferred partially (rare, but possible)

Valuation matters. Get a forensic accountant involved early. We’ve seen business owners try to undervalue their company to reduce what they pay. Courts don’t appreciate it.

If you’re self-employed, your income will be scrutinised. If you claim low income but live a lavish lifestyle, the court will investigate. They call it “lifestyle analysis.”

Debts: Who Pays What?

Debts are part of the matrimonial pot too.

- Joint debts (like a mortgage or joint credit card) are usually shared

- Individual debts depend on what they were used for

If you racked up £15,000 on a credit card funding family holidays and home improvements, that’s a shared debt.

If your ex racked up £15,000 gambling without your knowledge, the court may allocate it solely to them.

Its is advisable to close joint accounts and credit cards as soon as separation is on the cards. Protect yourself from future debts run up in both names.

Spousal Maintenance: Ongoing Financial Support

Sometimes, dividing assets isn’t enough. One person may need ongoing financial support.

Spousal maintenance is a regular payment (usually monthly) from the higher earner to the lower earner.

When Is It Awarded?

- One spouse can’t meet their needs from the capital settlement

- There’s a significant income disparity

- One person sacrificed their career for the family

How Long Does It Last?

- Joint lives – Until one of you dies or the recipient remarries

- Term order – Fixed period (e.g. five years) to allow the recipient to retrain and become self-sufficient

- Clean break – No maintenance at all (preferred where possible)

Courts increasingly prefer term orders or clean breaks. The goal is financial independence, not permanent dependence.

Clean Break vs Ongoing Connection

A clean break means no ongoing financial ties. You split assets, sign a consent order, and walk away.

This is the gold standard.

It stops either of you coming back later asking for more. It’s final.

When Is a Clean Break Possible?

- Both of you can meet your needs from the assets

- No children, or children are financially independent

- Neither needs ongoing spousal maintenance

When It’s Not Possible

- One person needs ongoing maintenance

- There are young children and maintenance is needed until they’re older

- The lower earner can’t afford housing without regular support

Even if you can’t achieve a full clean break now, you can structure maintenance to end after a set term, moving towards independence over time.

The Consent Order: Making It Legally Binding

You’ve agreed how to split everything. Great.

But without a consent order, it’s not legally binding.

A consent order is a court-approved document that sets out your financial settlement. It’s the only way to protect yourself from future claims.

Without it, your ex could come back in five, ten, even twenty years and ask for a share of your future assets, inheritance, or lottery win.

What Does It Include?

- How property is divided

- Pension sharing arrangements

- Lump sum payments

- Spousal and child maintenance (if any)

- A clean break clause (if agreed)

You can draft a consent order without going to court. You apply to the court, a judge reviews it, and if it’s fair, they approve it.

At Family Law Service, we help clients draft consent orders that are watertight and fair. We’ve seen too many cases where poorly worded orders left loopholes that caused problems later.

Our fixed fee Clean Break Consent Order packages gives you a professionally drafted consent order, prepared by trusted expert drafters, with all required supporting documents.“I remember an old Mediate UK client that came to us years after his divorce,” Jess explains. “He’d agreed everything verbally with his ex but never got a consent order. She remarried, won the lottery, then divorced again. Her second ex claimed against assets from her first marriage, and our client got dragged into legal mess. A consent order would have prevented it entirely.”

Negotiating Your Settlement: Mediation, Solicitors, or Court?

Here are the three most common routes:

1. Family Mediation

A neutral mediator helps you negotiate. It’s cheaper and faster than court. You both attend sessions, discuss options, and work towards an agreement.

Mediation works well if you can communicate reasonably and want to keep control.

2. Solicitor Negotiation

Each of you hires a solicitor. They negotiate on your behalf through letters and meetings. If you reach an agreement, it’s turned into a consent order.

This is the most common route. It’s formal but avoids court.

3. Court

If you can’t agree, a judge decides for you. It’s expensive, slow, and unpredictable. You lose control over the outcome.

Courts are a last resort. We always try to settle outside of court first.

Common Mistakes to Avoid

1. Assuming 50/50 Is Automatic

It’s not. The court starts with needs, not equality.

2. Hiding Assets

Don’t. Courts can order financial disclosure. If you’re caught hiding assets, you’ll lose credibility and face serious consequences.

3. Agreeing Without Legal Advice

Even if you trust your ex, get advice. You need to know what you’re entitled to and what’s fair.

4. Forgetting About Pensions

They’re often the biggest asset. Don’t overlook them.

5. Skipping the Consent Order

Verbal agreements are worthless. Get it in writing and approved by a court.

FAQs About Financial Settlements on Divorce

Do I have to split everything 50/50 in a divorce?

No. The court aims for fairness, not automatic equality. If you’ve been married a long time and contributed equally, 50/50 is likely. But if the marriage was short, or one person brought in significant assets, the split may be different. Needs come first, then contributions, then sharing.

Can my ex claim my inheritance in a divorce settlement?

Sometimes. If the inheritance is recent, kept separate, and the marriage was short, you’ll likely keep it. But if you’ve been married for decades, used the inheritance for joint expenses, or your ex has pressing housing needs, it can be included in the settlement.

What happens if we can’t agree on a financial settlement?

You’ll need to apply for a financial order and let the court decide. This is expensive and time-consuming. Mediation or solicitor negotiation is almost always better. Courts should be a last resort when all other options have failed.

How long does a financial settlement take?

If you agree quickly, a consent order can be drafted and approved in weeks. If you negotiate through solicitors, expect a few months. If you go to court, it can take over a year.

Do I need a consent order if we’ve agreed everything?

Yes. Absolutely. A verbal agreement or even a written one without court approval is not legally binding. Your ex could change their mind or come back years later asking for more. A consent order protects you both and makes the agreement final.

Can a financial settlement be changed after divorce?

Generally, no. Once a consent order is approved, it’s final. You can’t reopen it unless there was fraud, non-disclosure, or a major change in circumstances (like a child with special needs). This is why getting it right first time matters.

How Family Law Service Can Help You

At Family Law Service, we specialise in achieving fair, practical financial settlements that protect your future.

Some of the services we offer are:

- Fixed-fee financial advice so you know exactly what you’re paying

- Court Form Completion Form A, Form E

- Consent order drafting to make your agreement legally binding

- Barrister reviews for complex cases involving businesses, pensions, or high assets

“Our McKenzie Friends have been invaluable for clients who need to represent themselves in financial remedy hearings,” Jess explains. “We had a client who couldn’t afford full representation but desperately needed help understanding the court process. Our McKenzie Friend worked with her on our court prep package, helped her organise her financial disclosure, prepared her bundle, and even sat with her in court for moral support. She felt prepared instead of terrified, and the judge could see she’d done her homework. It made a real difference to the outcome.”

Our experts have helped hundreds of clients work though financial settlements, from straightforward clean breaks to complex disputes involving multiple properties and international assets.

Whether you’re just starting the process or you’ve been negotiating for months, we can help you move forward.